The overdraft setting applies to restricted users (and restricted shared accounts). An overdraft allows a user to continue to use services even though their account has dropped below zero. In essence, the overdraft value moves the “zero-point” allowing users to overdraw the account to the agreed limit. An overdraft can also be referred to as a credit limit.

Reasons for using an overdraft include:

-

Provide users with flexibility between budget, quote or allocation periods. For example, an overdraft allows a user to “draw on” a portion the next month’s quota allocation.

-

To Implement a credit system with credit limits rather than an up-front pay system.

-

Grant trusted users a “loan” on a case-by-case basis.

You can define an overdraft at two levels:

-

Globally as a default affecting all users and shared accounts.

-

On an individual user or account basis.

Change the overdraft limit for all users

The default overdraft is zero. You can change this limit.

-

Click the Options tab.

The General page is displayed. -

In the Account Options area, in Default overdraft limit for restricted users/accounts, enter the overdraft limit.

-

Click Apply.

Change the overdraft limit for specific users

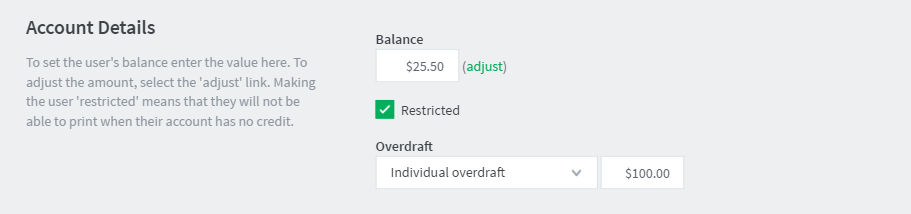

Optionally, you can apply a separate overdraft to an individual user (or shared account).

-

Click the Users tab.

The User List page is displayed. -

Select a user.

The User Details page is displayed. -

In the General Quota (built-in account) area, select the Restricted checkbox.

-

In Overdraft, select Individual overdraft.

-

Enter a positive value in the adjacent overdraft balance field.

-

Click Apply.

Comments